What is a CPA? What does a Certified Public Accountant do?

If you’re majoring in accounting or exploring accounting careers, you’ve probably been told that you need to obtain your CPA license. But what is a CPA?

To help you better understand what it can do for you and how to become one, we’re sharing some quick answers to the questions you have plus additional resources to help you take a deeper dive into the topics that interest you most.

Ready to start studying for the CPA Exam? Learn more about our exam review packages and find the right one to help you get Exam Day ReadySM!

Summary

A CPA is a Certified Public Accountant - someone licensed by the state to practice public accounting. To earn this license, you'll need to meet your state's education and experience requirements, plus pass the CPA Exam. However, taking these steps to earn your CPA license can open the door to more career opportunities and a higher income.

What is a CPA?

CPA stands for Certified Public Accountant.

- A Certified Public Accountant is an accounting professional who has met their state CPA license requirements and earned the license.

- The CPA license is the professional designation granted by state boards of accountancy to accounting professionals after meeting experience and education requirements and passing the Uniform Certified Public Accountant Examination, or CPA Exam.

What does a CPA do?

There isn't one particular thing a CPA does because it's not a job title or career path. Instead, it's a professional designation that offers accounting professionals more flexibility and mobility in their career. Not only because it allows them to practice public accounting independently, but because it proves expertise in more advanced accounting areas.

CPAs primarily work in five sectors:

- Public accounting

- Business and industry

- Government

- Education

- Not-for-profit

Within those sectors, CPAs work in a variety of roles, including, but not limited to:

- Financial accounting

- Management or cost accounting

- Internal or external auditing

- Tax preparation and planning

- Financial consulting

Take the next step: The Ultimate Guide to Launching Your Accounting Career

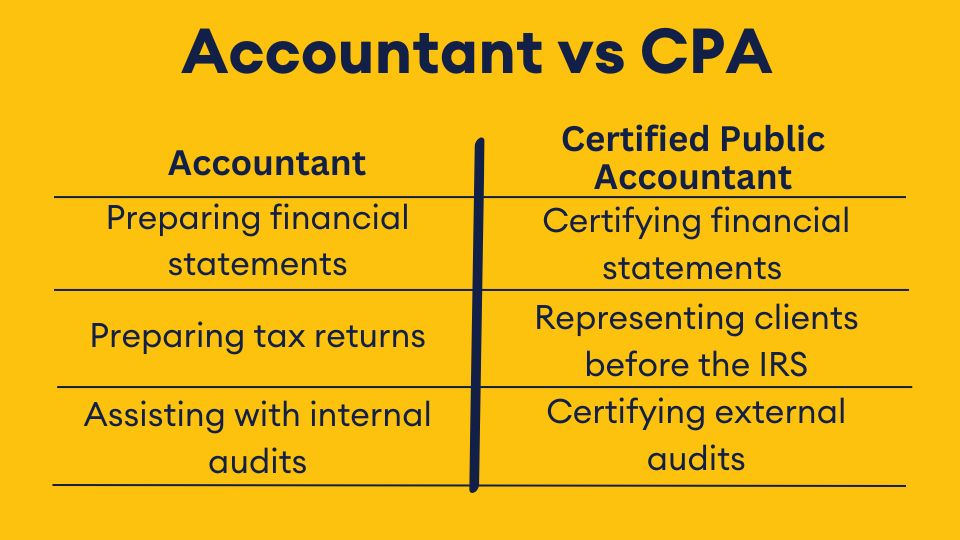

CPA vs. accountant: What’s the difference?

While all CPAs are accountants, not all accountants are CPAs. Accountants keep and interpret financial records, they can assist with tax preparation and generate financial statements. So, what is a CPA in this context?

Legally, you must have a CPA license to complete the following tasks or services:

- Certifying and submitting financial statements

- Conducting external company or organizational audits and sign off on audit reports

- Defending a tax return or representing clients before the IRS

Take the next step: What can a CPA do that an Accountant can't?

What skills should I have as a CPA?

CPAs should stay up-to-date on all tax updates and changes as well as updates to regulations and topics passed by the Financial Accounting Standards Board (FASB). In addition to accounting skills, a successful CPA will possess the following related skills:

- Leadership

- Critical thinking

- Written communication

- Technical abilities, such as Excel and business intelligence software

Take the next step: 7 Essential soft skills for accountants

Why should I get a CPA license?

Benefits of a CPA license | |||

Security | Opportunity | Satisfaction | Income |

Now that you have an answer to the question, "What is a CPA?" the next question you probably have is, "Why should I become one?"

Job security

There is currently a shortage of accountants as fewer students major in accounting1 and even fewer accountants choose to become CPAs. Compounding this problem, approximately 75 percent of the members of the American Institute of Certified Public Accountants (AICPA) are eligible for retirement2. Thus, the shortage could become significantly worse before it gets better.

Between the lack of professional pipeline in the accounting profession and the continued need for knowledgeable CPAs, those who do join the profession have excellent job security and a wide variety of opportunities available.

Increased career opportunities

Between having more freedom to work independently in financial accounting, audit and taxation, as well as having proven knowledge and expertise, CPAs are more sought after than non-licensed accountants. Not only do firms, government agencies, and private companies want to bring CPAs on to their staffs, CPAs can also open their own business, providing services to individuals, businesses and non-profits.

Also, CPAs are often eligible for higher-ranking roles within organizations, including senior management all the way to CFO.

Job satisfaction

While entry-level accounting positions may be a bit repetitive or boring, having a CPA license means you're more qualified to perform more specialized tasks that suit your interests or that you find more meaningful. For example, if you enjoy working more directly with clients, you may find being able to assist them directly with financial planning or defend them against the IRS to be more fulfilling. Similarly, if you enjoy strategy and planning, having a CPA license shows you have more in-depth knowledge of financial analysis.

Increased earning potential

More opportunities and more responsibility often translate into a higher income, and typically, CPAs earn significantly more than non-CPAs. The 2023 average CPA salary was $96,7523, though the average range is between $60,874 to $150,6124. Accountants without a CPA license tend to earn less with an average range between $47,138 and $82,167.

It's important to note that things like experience, location and role also affect salary, so it's important to factor these in when considering earning potential.

Take the next step: CPA salary insights

How do I become a CPA?

Three E's | Minimum requirements |

Education | 150 semester hours of college or post-graduate education |

Experience | At least one year of qualifying experience |

Exam | Pass four sections of the CPA Exam |

When we answered the question, "What is a CPA?" at the beginning of the article, we mentioned meeting state requirements. There isn't one single answer to how to become a CPA as all states have slightly different requirements. However, all states require CPAs to meet the "Three E's" in some way.

Education

All CPAs must have a bachelor's degree and 150 semester (225 quarter) hours. However, the specific amount of upper-level accounting courses, business courses, and other requirements are left to individual states.

Take the next step: How to get 150 hours for CPA licensure

Experience

All states require at least one year of accounting experience to obtain licensure. Again, you'll want to check with your state board of accountancy to see what type of experience you'll need, the exact amount of hours and if part-time work is accepted.

Exam

You have to pass the CPA Exam - this is the one universal requirement that doesn't change between states. The CPA Exam consists of four sections. All candidates must pass the three Core sections:

- Financial Accounting and Reporting (FAR)

- Auditing and Attestation (AUD)

- Taxation and Regulation (REG)

Core sections test the ability to understand, apply, analyze and evaluate the foundational topics a newly licensed CPA is expected to know. Also, candidates must pass one of three Discipline sections to gain specialized knowledge in more advanced topics.

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

Take the next step: How to become a CPA

Download our FREE 2024 CPA Exam Guide

If you want to learn more about the CPA Exam, download our free 2024 CPA Exam Guide. This ebook includes everything you need to know, including the exam format, types of questions in each section, study tips and practice questions.

What is a CPA? Frequently asked questions

CPA stands for Certified Public Accountant

This designation allows you to certify financial statements for the SEC, represent clients before the IRS and sign off on audits. However, the CPA designation also shows you have more advanced knowledge and expertise than non-licensed accountants.

Becker has outlined the CPA requirements by state and territory to help make it easy to understand what you need. You can also check your state's board of accountancy.

Before you apply, you need to make sure you meet the state requirements to sit for the exam. If you do, you'll need to submit the proper documents, pay the fee, and apply through the state where you plan to be licensed. Once your application is accepted, you can schedule to sit for your first section.

Even though most people use CPA certification and CPA license interchangably, there isn't a recognized CPA certification. Because it's regulated by the state, you're working toward your CPA license not certification.

However, a few states offer a CPA certificate, which shows that you've passed all four sections of the CPA Exam but haven't fulfilled the other licensure requirements.