How to Become a CPA

The path to becoming a CPA may seem overwhelming. There are several steps you have to meet and each state has different specific requirements and timelines. Fortunately, the benefits of being a CPA are well worth the hard work. To help you on your path, we're sharing how to become a CPA and answering your frequently asked questions to help simplify the process and help you get a plan in place.

Ready to start studying for the CPA Exam? Learn more about our exam review packages and find the right one to help you get Exam Day ReadySM!

Certified Public Accountant requirements

Before we start breaking down the steps, the first thing you should do is check with the state where you plan to get your CPA license because every state is different. For example, some states allow candidates to submit part-time work toward the experience requirement while other states only accept full-time employment. Other states allow internships to count toward course credit, others don't. So before you do anything, check out the Certified Public Accountant requirements in your state.

Take the next step: CPA requirements by state

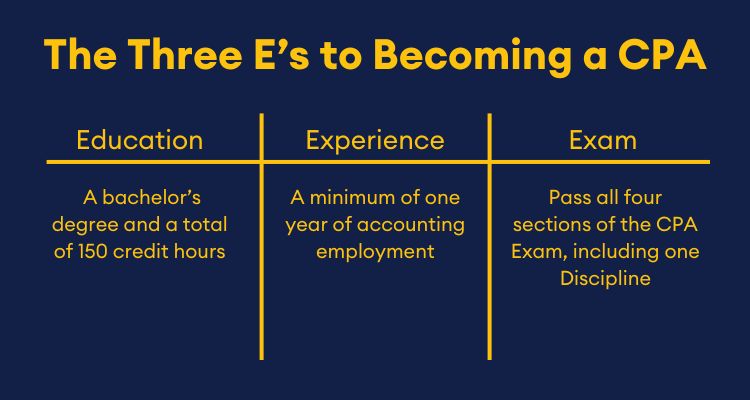

How to become a CPA: The three E's

All states require the "Three E's" in some form: education, experience, and the CPA Exam. Let's look at the minimum requirements that are universal to all states.

Education

All states require a minimum of a bachelor's degree and at least 150 semester hours (225 quarter hours) of post-secondary education from an accredited college or university. Some states do require a concentration in accounting or a specific amount of accounting and business coursework.

Some CPA candidates choose to complete the 150-hour requirements with undergraduate courses, others earn the additional hours by getting their master's degree. It's important to choose the path that works best for you while meeting state requirements.

Take the next step: 150 credit hours to the CPA license

Experience

All CPAs will need to work as an accountant under a licensed, active CPA for a minimum of one year. Many states do allow full or part-time employment as long as the specific number of hours are met within a set timeframe. They also allow experience gained in public accounting, private accounting, government agencies, and academia, so you do have several career options available to qualify as a CPA but again, check your state's requirements.

Exam

All states require CPA candidates pass the CPA Exam. This consists of four individual exams, including three Core sections that all students must take. You must also choose a Discipline from three options. A Discipline builds on one of the Core subjects, allowing candidates to gain more specialized knowledge in the area they are more likely to work in.

| Core Exam sections | Discipline Exam sections |

| Auditing and Attestation (AUD) | Information Systems and Controls (ISC) |

| Financial Accounting and Reporting (FAR) | Business Analysis and Reporting (BAR) |

| Taxation and Regulation (REG) | Tax Compliance and Planning (TCP) |

All states have requirements to sit for the CPA Exam, usually less stringent than the requirements to become a CPA. You'll need to pay the CPA Exam fees, apply for the exam, and get your authorization to test or notice to schedule from the National Assocation of State Boards of Accountancy.

Depending on your state, you'll have at least 18 months to pass all four sections of the CPA Exam, but this clock doesn't start until you pass your first section. Three organizations, including the American Institute of Certified Public Accountants (AICPA), the National Association of State Boards of Accountancy (NASBA) and Prometric, have a contractual agreement to administer the CPA Exam.

Take the next step: Learn about the CPA Exam content

How to become a CPA: Finalize your requirements

After you pass the CPA Exam and have your experience and education, you still need to ensure you complete any additional requirements. For example, after passing the CPA Exam, many states also have ethics requirements, such as taking a course in your state's ethics and completing an open-book exam, or something similar.

Once you can check off all the requirements, you can officially apply and receive your CPA license. Then the hard work will truly pay off!

Get our Free CPA Exam Guide

If you're ready to start taking the steps to become a CPA, passing the CPA Exam is probably the hardest part. Learn everything about the CPA Exam, from what content is covered in each section to what kind of questions you can expect, when you download our free guide, "The CPA Exam Guide."

How to become a CPA: FAQs

Why become a CPA?

Many people are becoming CPAs due to the job security and higher salary potential. Demand1 for accountants is expected to grow 4 percent through 2032. Specifically, there's a much higher need for CPAs due to their proven knowledge and skills in more complex accounting topics.

Because they're higher in demand and have more skills and knowledge, CPAs tend to have a higher earning potential than their non-CPA peers.

Take the next step: CPA average salary

What are the minimum Certified Public Accountant requirements?

The minimum requirements to become a CPA are:

- One year of relevant, accepted experience in accounting

- 150 hours of post-secondary education

- Pass all four sections of the CPA Exam

How long does it take to become a CPA?

In total, it takes about seven years to become a CPA. However, that includes the four years of college you're probably either close to finishing or have already finished.

Here's a breakdown:

- You'll need 150 semester hours (225 quarter hours) which takes most people around five years. You'll need at least 120 semester hours (180 quarter hours) to sit for the CPA Exam.

- Passing all four sections of the CPA Exam takes between one and two years.

- You'll need at least one year of qualifying employment.

It's important to note that you can work on taking the CPA Exam while you're finishing the 150 hours of credit or working on fulfilling the work requirements. But as you look at how to become a CPA, it's also important to create a timeline that works for you.

How do I become a CPA without a degree in accounting?

If you've followed a nontraditional path to accountancy, you may be wondering, "Do I need an accounting degree to be a CPA?" Typically, no. While all states require CPAs have at least 120 semester hours (180 quarter hours) to sit for the CPA Exam and 150 semester hours (225 quarter hours) to get your license, not all states require an accounting degree or concentration. In fact, many candidates earn their bachelor's degrees in finance or business administration, then take additional hours if their state requires a specific amount of accounting coursework.

What is a CPA license?

A CPA license is a state-issued, professional designation that allows accountants to certify financial statements, complete external audits, and represent clients in front of the IRS.

Take the next step: What is a CPA?

How can I become a CPA without a master's degree?

While you need at least 150 semester hours to get your license, and most accountants do earn their master's degree to meet the hours requirements, you do have other options. You can take additional undergraduate courses to work on a double-major, gain additional skills in topics that interest you or support your accounting career, or you can take CLEP classes that allow you to test out of college classes and still earn credit.

How hard is it to become a CPA?

Earning your CPA license is challenging. Most candidates spend between 300 and 400 hours studying and then also meeting the education and experience requirements. However, using a CPA Exam review course, like Becker, helps you put those hours to good use and increase your likelihood of passing on the first try.

Take the next step: How long does it take to study for the CPA Exam?

How do you become a CPA as an international accountant?

The U.S. CPA license is issued at the US state or jurisdiction level. Non-US resident CPA candidates who meet the board of accountancy CPA eligibility requirements in one of the 55 US jurisdictions will qualify as US CPAs.

If you meet the requirements and want to take the CPA Exam, keep in mind that the exam must be taken in English. The Prometric test centers does offer the CPA Exam internationally in centers around the globe.

Can I become a CPA online?

If you're wondering how to become a CPA online, you should start by checking your state's CPA licensure requirements. All states require a set amount of work experience and education. Typically, if you can earn your educational requirements and experience hours online, you can become a CPA online. You can also study online with Becker! We offer comprehensive self-guided and LiveOnline options to suit your learning needs while preparing for the CPA Exam!