The CPA Exam proves your competency in financial accounting, taxation, and auditing, as well as skills related to data and technology, problem-solving, analytical ability, and research. This thoroughness is intentional, designed to match the knowledge required for modern public accounting. In 2024, the AICPA restructured the CPA Exam to match the profession's trend towards specialization now requiring all candidates to pass three Core sections and choose from one of three Disciplines. We're providing some tips on how to choose your CPA Exam Discipline so you can move forward in your career.

What are CPA Disciplines?

All CPAs must pass three Core sections of the CPA Exam which tests foundational knowledge of concepts.

- Financial Auditing and Reporting (FAR)

- Auditing and Attestation (AUD)

- Taxation and Regulation (REG)

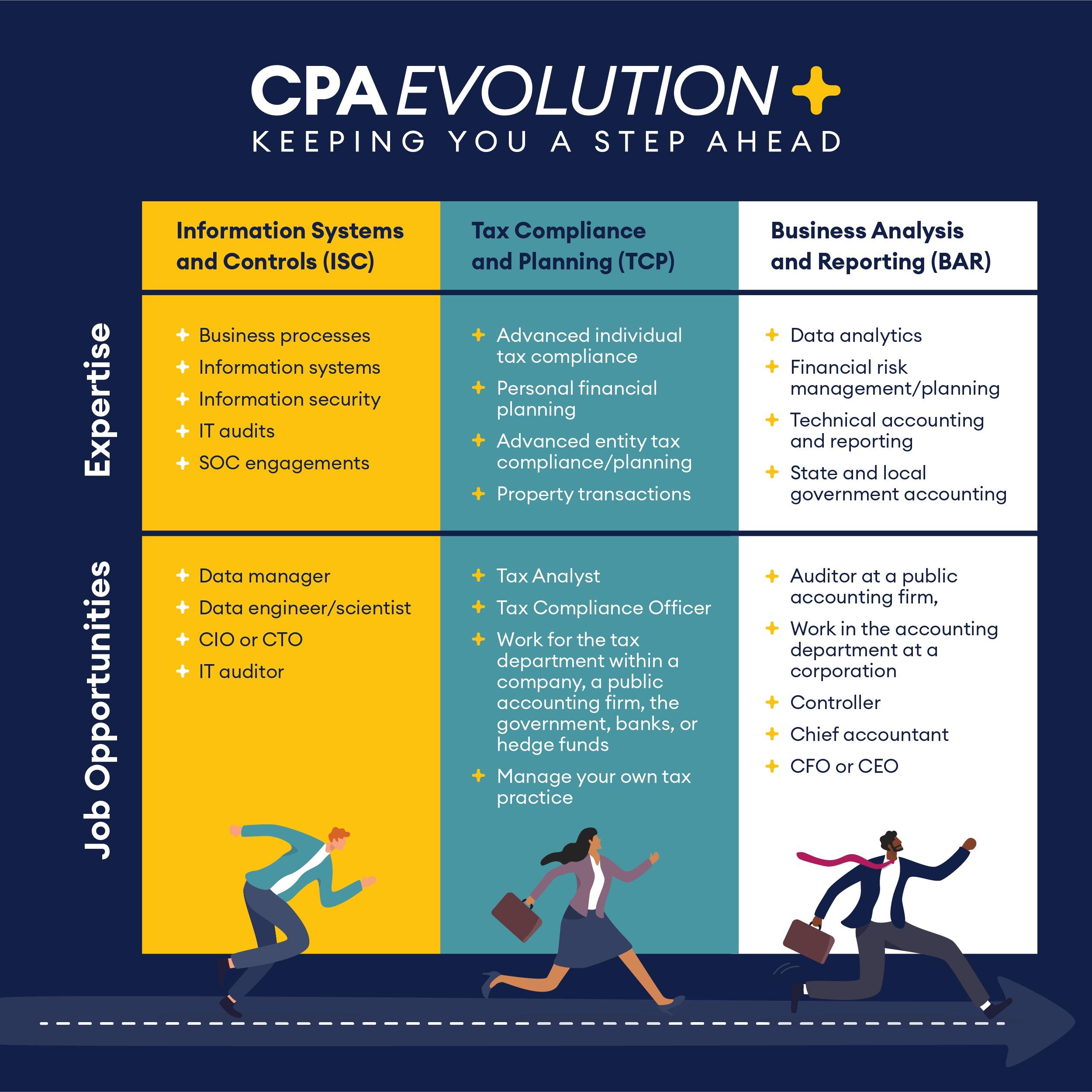

Each CPA Exam Discipline section builds on one of the foundational Core sections, and candidates must pass one to demonstrate their specialized expertise in an area.

- Business Analysis and Reporting (BAR) builds on concepts tested in FAR

- Information Systems and Controls (ISC) builds on concepts tested in AUD

- Tax Compliance and Planning (TCP) builds on concepts tested in REG

Before you dive in, National Instructor Mike Potenza shares the three questions you should ask yourself before choosing your CPA Discipline.

Which CPA Exam Discipline section should I choose?

There isn't a singular right answer. Before you make your choice, consider the following:

- What area am I most confident in?

- Would I rather work in accounting, tax, or audit?

- Where do I want my career to go?

Remember, each area is in demand and specialized knowledge will be needed in the future, so there's plenty of opportunities for career advancement no matter which CPA Exam Discipline you choose. Also, choosing a Discipline doesn't set your career path in stone, so even if you want to work in audit, but think you'd have an easier time passing a tax-specific exam there's nothing wrong with that either.

So, if you’re about to start studying for the exam, what Discipline track should you follow?

Information Systems and Controls

If you’re skilled or interested in information technology, internal controls, cybersecurity, or data management, you may want to sit for Information Systems and Controls (ISC) exam.

Information technology, security and data management are a crucial and growing field of expertise in public accounting, as automation increasingly performs more rudimentary accounting tasks while also creating more demand for accountants who know how to derive insights from data.

As a CPA who chooses ISC, some opportunities may include a data manager (which could lead to a position as a CIO or CTO) or IT auditor at a public accounting firm while also having fundamental accounting skills and the credential to prove it. Definitely a sweet spot for many CPA firms these days!

The complete guide to the ISC CPA Exam |

Tax Compliance & Planning

If your interest is in pursuing a career in tax and compliance, prepare for the Tax Compliance and Planning (TCP) exam.

Though certainly more “traditional” in a sense than ISC, TCP is just as cutting-edge in its own way since taxes and compliance rules for businesses and individuals are constantly changing. This is a vital public accounting competency for which there will always be a strong demand.

If you closely follow tax rules and changes and enjoy the thought of helping clients ensure they’re in compliance and benefitting from tax regulations, consider choosing this CPA Discipline. As a CPA who specializes in TCP, some opportunities may include working for the tax department within a company, a public accounting firm, the government, banks, hedge funds or even managing your own tax practice.

The complete guide to the TCP CPA Exam |

Business Analysis and Reporting

If you enjoy the more technical aspects of accounting and reporting, opt for the Business Analysis and Reporting (BAR) exam.

This is a category that is more general than the other two but also elevates your basic accounting competencies above what is taught in the Core sections. Specializing in BAR allows you to help businesses confirm they are gathering the right information needed to analyze financials, make decisions and report to investors and other stakeholders – an always-important function of accounting, especially as new regulatory rules are constantly taking shape. As a CPA who specializes in BAR, you could pursue auditing at a public accounting firm, work in the accounting department at a corporation, become a controller, chief accountant, or even a CFO or CEO.

The complete guide to the BAR CPA Exam |

Researching your CPA Exam Discipline

Whatever Discipline track you choose to follow, be sure to do your own research and consult with trusted advisors to get their thoughts. And if you're worried that you'll choose the wrong one, don't worry. You're not locked into a Discipline—you can always select another choice until you pass. After you pass your Discipline and Core sections and meet your other requirements, you will receive a general CPA license which will not reference your Discipline. This way, the one you choose won't negatively impact your career path.

At Becker, we encourage you to approach this choice with excitement, as it offers you an opportunity to learn more about your desired career specialty. If you’re a career accountant, you may already have an advantage on your chosen CPA Discipline, given your extra work experience. But whatever level of your career you’re at, and no matter which section you choose, you’ll still ultimately become a CPA.

Try all three CPA Exam Disciplines with Becker

Becker makes it easy to choose a Discipline by providing you with access to all three Disciplines for 30 days so you can get a better understanding of what to expect on each exam.