As tax season slowly approaches, and tax law changes are enacted, it’s time for tax professionals to review changing tax rules. Let’s get started!

What’s changing?

Your first question may be, what are the new tax laws? The loss limitation rules of the Internal Revenue Code are constantly expanding and evolving, and the rules are highly complex. As a result, it seems that tax law changes add new barriers for deducting losses each year. In tax year 2021 specifically, loss limitation rules are being reinstated after being suspended due to the pandemic. This tax law change will impact tax preparers and clients alike.

What are loss limitation rules?

In general, loss limitation rules help to outline how much of a business loss is deductible for tax purposes. Initially, the loss limitation rules began as a deterrent against abusive tax shelters being formed with the sole intent of avoiding taxes. While some of the restrictions have been suspended for certain tax years, one of the many tax law changes in 2021 is the return of all loss limitation rules. With old and new loss limitations in effect, understanding this dynamic and complex area of tax law will greatly help with tax strategy and client tax planning.

First, a little history. In the beginning, there were simple tax basis and at-risk rules of Internal Revenue Code Section 704 and 465. In order to be able to deduct the loss against other income, a taxpayer must have:

- Adequate tax basis and

- Be considered at risk for the loss amount

To further enhance the loss deductibility restrictions, the passive activity rules entered the scene in 1986. Passive activity rules require a taxpayer to materially participate in an activity to be able to deduct a loss from the activity against ordinary income. Of course, if a taxpayer does not materially participate in the activity, the loss is deemed passive and is only deductible against passive income. These rules made up the loss limitation world until the Tax Cuts and Jobs Act of 2017.

Recent tax law changes - loss limitation rules

The excess business loss limitation and net operating loss (NOL) limitations were added in 2018 as part of the Tax Cuts and Jobs Act. Now, if a taxpayer has adequate tax basis, is at risk for the activity, and materially participates in the activity, the loss may still be limited due to the addition of the excess business loss and net operating loss limitation rules.

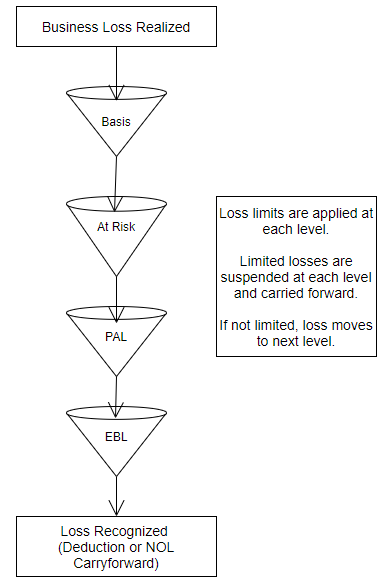

To throw in another twist, the loss limitations must be applied in order. Additionally, any amount not allowed is carried over as the level of the specific loss limitation. The proper order of loss limitation is:

Tax basis à At risk à Passive activity à Excess business loss à Net operating loss limitation

Figure 1 – Order of loss limitation

PAL= Passive Activity Loss

EBL= Excess Business Loss

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 suspended the excess business loss and net operating loss limitations for tax years 2018 - 2020 to offer relief for taxpayers experiencing financial difficulty due to COVID. At the time of writing this article in October 2021, the loss limitation rules are all fully reinstated for this tax year. Let’s look at the current loss limitation situation.

Excess business loss limitations

The excess business loss limitation applies to noncorporate taxpayers and does not allow a loss that exceeds $262,000 (unmarried) or $524,000 (married) for 2021. The threshold amounts are adjusted annually for inflation. An excess loss not allowed in the current year is carried forward as a net operating loss. After a loss passes the hurdles of tax basis, at risk, and is not considered passive, the loss cannot exceed the excess business loss limitations. Check out this example.

|

Example 1 - Excess business loss limitation |

|

FACTS: Mary is single and earns wages of $360,000. She also owns a sole proprietorship with $100,000 of income and $400,000 of allowed deductions ($300,000 loss). Mary has enough tax basis to cover the loss and is considered at risk for the loss amount, and she materially participates in the activity. How much of Mary’s loss is deductible under the excess business loss rules? SOLUTION: Mary can deduct $262,000 of the loss this year. $38,000 is disallowed under the excess business loss rules for 2021. She will carry the $38,000 excess business loss forward as a net operating loss. |

Net operating loss limitations

Net operating loss rules have expanded in recent years as well. A net operating loss is an excess of deductions over income for the operation of a business. Since the Tax Cuts and Jobs Act of 2017, net operating losses are only allowed to be carried forward indefinitely, not carried back. In response to the pandemic, the CARES Act of 2020 allows net operating losses arising in tax years 2018 - 2020 to be carried back for five years and carried forward indefinitely.

However, net operating losses arising in tax year 2021 and beyond may only be carried forward indefinitely. In addition, for tax years 2021 and beyond, a net operating loss may not exceed 80% of taxable income computed without regard to the NOL deduction. This 80% limitation was also suspended for tax years 2018 - 2020 by the CARES Act. After applying the excess business loss limitation, the taxpayer’s net operating loss is limited to 80% of taxable income. Look at an example of how the excess business loss limitation and the net operating loss limitation rules interact.

|

Example 2 |

||||||||||||||||||||||||||||||

|

FACTS: Darius is single and earns $300,000 in wages. Darius owns a sole proprietorship and materially participates in the business. He also has sufficient tax and at-risk basis in the sole proprietorship. In the current year, Darius has $30,000 in income and $400,000 in expenses ($370,000 business loss). From prior years, Darius has NOL carryovers that total $150,000. SOLUTION:

|

Tax law changes in 2021 - Final thoughts

The tax law limitations on the deductibility of losses are extensive and complicated. As such, understanding each aspect of loss limitation rules is essential for advising clients regarding business losses. The fluctuating limitations that are applicable in some tax years, but not others, add an interesting twist to the current tax year. Preparing multi-year tax projections may be a useful tool in determining how best to utilize current year tax deductions and loss carryovers for your client. If your client’s business is experiencing a loss in tax year 2021 or has loss carryovers to 2021, make sure to refresh your understanding of the loss limitation rules and all tax law changes in 2021.

The tax law changes content contained in this article is for informational purposes only and is not tax advice. You should consult a tax advisor for advice applicable to your situation.

Helpful resources

- IRS: Excess business losses

- IRS: Net operating losses

- IRS: Publication 925(2020), Passive Activity and At-Risk Rules