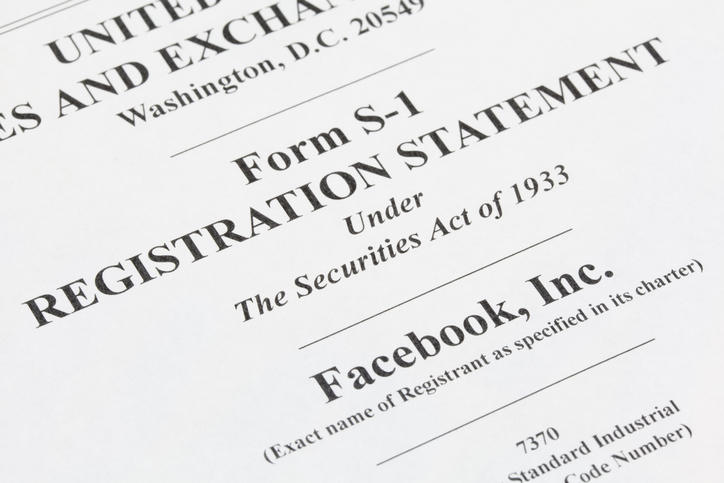

Before taking a company public in the United States, the organization needs to complete and submit SEC Form S-1. We're providing insight into this Form, including its purpose and structure, the accountant's role in preparing key financial statements, and best practices to ensure accuracy and avoid problems during the registration process.

What is SEC Form S-1?

Form S-1 is a mandatory filing with the Securities and Exchange Commission. The SEC requires a Form S-1 for the initial registration of new securities for public companies based in the United States while foreign issuers of securities in the U.S. use a similar alternative SEC Form F-1.

Form S-1 is also used by existing SEC registrants when they don’t meet the requirements for another registration form, such as Form S-3. Companies can use the online Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system to submit documents under the Securities Act of 1933. The text and general instructions for completing the Form S-1 are available on the SEC’s website.

The role of Form S-1 in the public offering process

Any security that meets certain criteria must have an S-1 filing before shares can be listed on a national exchange, such as the New York Stock Exchange. Companies usually file SEC Form S-1 in anticipation of their initial public offering (IPO). Investors can view Form S-1 filings online to perform due diligence on new offerings and make informed decisions

Any subsequent amendments or changes made by the issuer are filed under Form S-1/A.

Legal and regulatory context

SEC Form S-1 is mandated under the Securities Act of 193. This was enacted to guarantee that investors receive necessary information regarding the securities offered and to prevent fraud in the sale of those securities. This Act set the foundation for the public disclosure of essential business and financial information to protect investors and ensure market integrity.

Key components of SEC Form S-1

Form S-1 has two parts intended to ensure investors receive significant information regarding securities offered and prohibit fraud in the sale of the offered securities. It is critical to understand that the issuer is responsible for any material misrepresentations or omissions.

- Part I, the “prospectus”, is a legal document providing information about the issuer’s business operations, the use of proceeds, total proceeds, the price per share, description of management, financial condition, the percentage of the business being sold by individual holders and information on the underwriters.

- Part II includes recent sales of unregistered securities, exhibits, and financial statement schedules. It is not legally required to be a part of the “prospectus”.

Form S-1 does allow registrations to provide certain required information in Part I through incorporation by reference of previously filed forms, such as Form 10-K and Form 10-Q. This is commonly referred to as “backward incorporation.” However, Form S-1 does require the registrant to describe all material changes in the registrant’s affairs that have occurred since the end of the latest fiscal year and have not been described in a previously filed Form 10-Q or Form 8-K.

The accountant’s role in preparing Form S-1

- Ensuring that all financial statements and disclosures are accurate and compliant with GAAP and SEC regulations. Misrepresentations can result in legal liabilities for the issuer.

- Preparing, auditing, or reviewing the financial statements included in Form S-1, including balance sheets, income statements, and statement of cash flows.

Challenges when preparing or filing Form S-1

Certain smaller reporting companies (SRC) are also permitted to incorporate by reference documents filed by the registrant after the effective date of the registration statement prior to the termination of the offering. This is commonly referred to as “forward incorporation” since the documents will be incorporated by reference will be filed in the future. A SRC must comply with eligibility requirements contained in the General Instruction VII and Item 12 of Form S-1.

A critical point is that when a Form 10-K is incorporated by reference in a Form S-1, the SEC requires the financial statements to be current as of both the filling and effective dates of the registration statement. As a result, separate financial statements may be required in a Form S-1 prospectus if the incorporated financial statements do not reflect certain events subsequent to the date of those financial statements. Certain types of subsequent events may require revised financial statements.

Requirements exist in S-X 3-12 about the “age” of the financial statement (i.e., how old the most recent financial statements are) and the periods required to be covered. Exceptions also exist for which financial statements may be omitted from a draft registration statement for certain filings per guidance issued by the SEC’s Division of Corporation Finance.

Best practices when preparing Form S-1

It is critical that a private company preparing a Form S-1 the required financial statements and related disclosures should be evaluated for compliance with relevant U.S. GAAP requirements and accounting standards that apply specifically to public companies. Form S-1 may not include private company-only exceptions available within U.S. GAAP.

Additionally, transition provisions for some new accounting pronouncements can be different for a public-business enterprise (PBE) and a non-PBE. Emerging Growth Companies (EGC) and Smaller Reporting Companies (SRC) also have special rules available with transition to new standards.

The SEC established provisions in Securities Act Rule 436 to ensure an accountant is aware of the use of its report and the context in which it is to be used. An accountants’ consent is a document signed by an independent accountant. It “consents” to the use of its report in the registered filing.

In short, accountants must ensure the following when preparing a Form S-1:

- Maintain clear communication with legal, auditors, and management

- Provide clear and accurate financial data

- Stay updated on SEC filing requirements

Take the next step with Becker CPE courses

Whether you need to prepare a Form S-1 or want to learn more about financial statements and reporting, Becker has the CPE courses you need! Check out these courses to take the next step:

- SEC Reporting Requirements Part 1

- GAAP Financial Statements (ASC 205-235)

- Meeting SEC Disclosure Requirements: MD&A, Part 1